Browsing the Complexities of Foreign Exchange Trading: How Brokers Can Aid You Remain Informed and Make Informed Choices

In the fast-paced globe of forex trading, remaining educated and making well-informed decisions is important for success. Brokers play an essential duty in this complex landscape, offering experience and assistance to browse the complexities of the market. However just how specifically do brokers assist traders in staying ahead of the curve and making notified options? By exploring the ways brokers supply market evaluation, understandings, threat monitoring strategies, and technical devices, investors can gain a deeper understanding of exactly how to successfully utilize these sources to their benefit.

Duty of Brokers in Foreign Exchange Trading

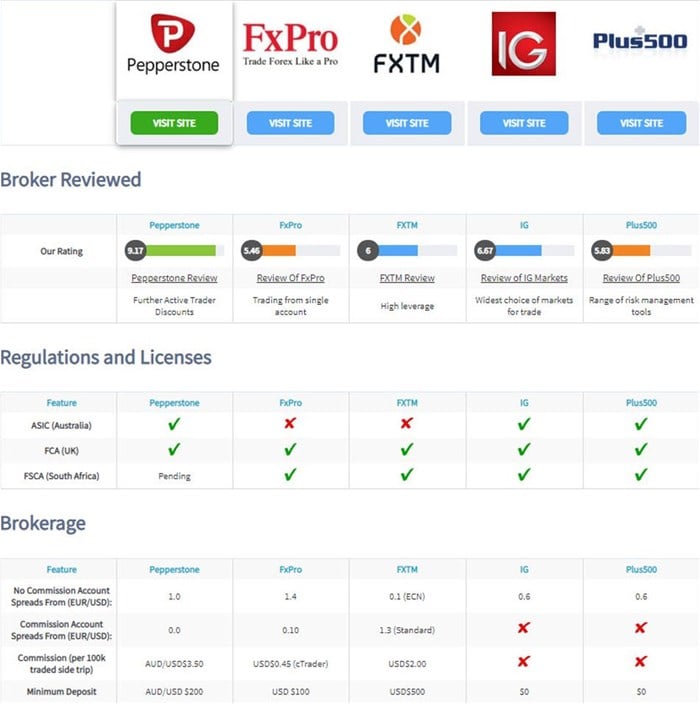

In the realm of Forex trading, brokers play an essential function as intermediaries promoting purchases in between traders and the international money market. forex brokers. These monetary experts serve as a bridge, connecting individual investors with the complex and huge globe of foreign exchange. Brokers give a platform for investors to access the market, offering devices, resources, and market understandings to assist in making educated trading decisions

Among the primary features of brokers is to carry out trades in support of their customers. With the broker's trading platform, traders can buy and offer money sets in real-time, benefiting from market fluctuations. In addition, brokers offer utilize to traders, enabling them to control bigger placements with a smaller sized amount of funding. This attribute can enhance both losses and earnings, making risk management a crucial aspect of trading with brokers.

Furthermore, brokers give important educational resources and market evaluation to help investors navigate the intricacies of Forex trading. By remaining notified regarding market fads, financial signs, and geopolitical occasions, traders can make tactical decisions with the assistance and assistance of their brokers.

Market Evaluation and Insights

Providing a deep dive into market patterns and using beneficial understandings, brokers equip traders with the required tools to navigate the intricate landscape of Forex trading. Market analysis is a vital aspect of Foreign exchange trading, as it involves analyzing different variables that can affect money cost motions. Brokers play a crucial duty in this by giving traders with up-to-date market analysis and insights based on their know-how and study.

Through technological analysis, brokers aid investors recognize historic cost data, identify patterns, and predict potential future rate activities. Furthermore, fundamental analysis enables brokers to review financial indications, geopolitical occasions, and market information to examine their effect on currency values. By manufacturing this info, brokers can use traders useful understandings into prospective trading possibilities and dangers.

Furthermore, brokers typically provide market records, newsletters, and real-time updates to maintain investors educated regarding the most current advancements in the Forex market. This constant flow of info makes it possible for traders to make educated decisions and adjust their techniques to changing market problems. In general, market evaluation and understandings used by brokers are important tools that empower traders to browse the vibrant globe of Forex trading efficiently.

Threat Monitoring Techniques

Navigating the unstable terrain of Foreign exchange trading necessitates the application of robust threat administration approaches. In the globe of Foreign exchange, where market changes can happen in the blink of an eye, having a strong danger management plan is vital to protecting your investments. One essential strategy is setting stop-loss orders to automatically shut a profession when it reaches a certain undesirable price, restricting prospective losses. In addition, diversifying your portfolio throughout various money pairs and asset classes can assist spread out risk and secure versus significant losses from a single trade.

Remaining educated concerning global economic occasions and market news can assist you expect prospective dangers and change your trading methods as necessary. Inevitably, a self-displined strategy to take the chance of monitoring is essential for long-term success in Foreign exchange trading.

Leveraging Modern Technology for Trading

To effectively navigate the intricacies of Foreign exchange trading, making use of sophisticated technological tools and systems is essential for maximizing trading methods and resource decision-making processes. In today's vibrant and hectic market environment, investors count heavily on technology to gain an one-upmanship. One of the essential technological developments that have changed the Foreign exchange trading landscape is the growth of trading systems. These platforms offer real-time data, progressed charting tools, and automated trading capabilities, enabling investors to execute professions successfully and respond promptly to market movements.

In addition, mathematical trading, also called automated trading, has ended up being significantly prominent in the Forex market. By utilizing algorithms to evaluate market problems and implement trades immediately, investors can remove human feelings from the decision-making process and make the most of opportunities that develop within milliseconds.

Additionally, making use of mobile trading applications has encouraged traders to remain connected to the market whatsoever times, enabling them to monitor their settings, obtain alerts, and place trades on the go. In general, leveraging technology in Forex trading not just enhances effectiveness but also provides investors with useful understandings and devices to make educated choices in a highly open market setting.

Establishing a Trading Plan

Crafting a distinct trading plan is vital for Forex investors intending to navigate the intricacies of the marketplace with precision and tactical insight. A trading plan acts as a roadmap that details a trader's objectives, threat tolerance, trading strategies, and strategy to decision-making. It assists traders keep self-control, manage feelings, and stay concentrated on their goals amidst the ever-changing characteristics of the Forex market.

Final Thought

In final thought, brokers play a crucial role in assisting investors navigate the intricacies of forex trading by offering market analysis, insights, risk management approaches, and leveraging technology for trading. Their knowledge and guidance can help investors in making informed decisions and creating effective trading plans. forex brokers. By dealing with brokers, traders can remain notified and raise their chances of success in the foreign exchange market